Commentary by Keenan Yoho, Banor Senior Advisor

The Return of Sovereignty and the New Operating Logic

The Rise of Sovereignty

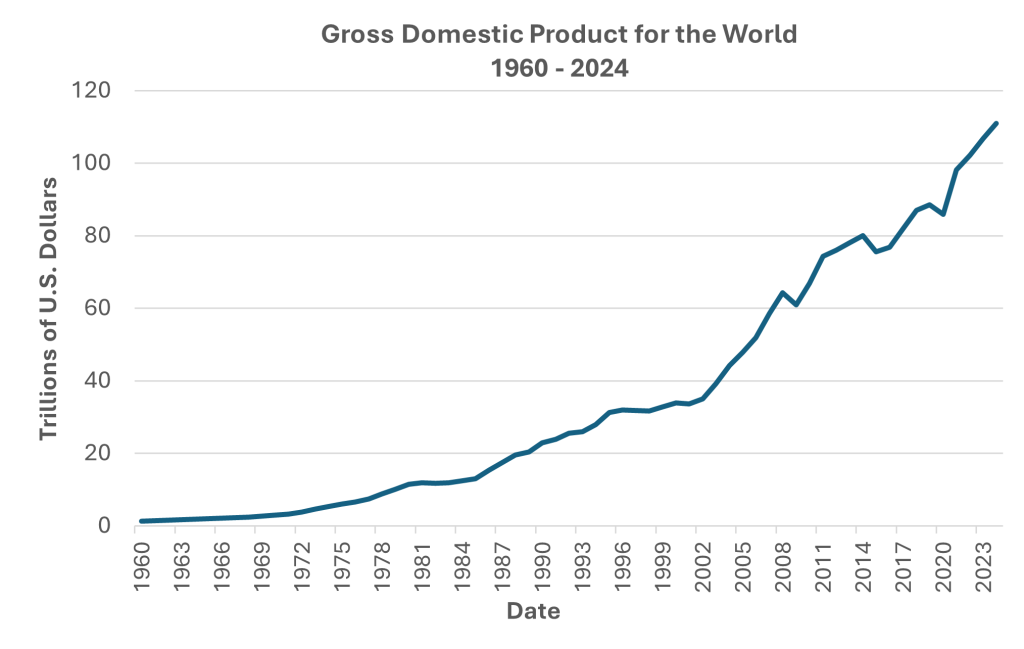

After 1945, the United States built an order that combined institutions with enforcement and liquidity. The arrangement was simple. Washington underwrote security and kept the system open. In return, allies accepted American primacy because it reduced uncertainty, stabilized Europe through NATO, and provided predictable procedures through the United Nations. The result was a long period of expanding trade and rising output under American protection.

Source: Federal Reserve Bank of St. Louis

Sovereignty Contested

Sovereignty is not a legal label. It is the capacity to refuse coercion and impose terms. A sovereign state must: : be able todefend its borders using military force, be a significant economic force at a regional or global scale, and be able to protect its capital through a credible last resort deterrent (such as a nuclear weapon) that makes conquest prohibitive. Under this standard, sovereignty is rare andit becomes clear that there are not more sovereigns in the world but far fewer. Two to be exact: the United States and China. Most states fall into subordinate positions. Some are protected states that rely on external guarantees for ultimate security. Some are entrepôt states whose prosperity depends on trade, finance, and logistics but are structurally exposed to blockades, sanctions, supply denial, or boycotting of their exports. . Some are buffer states located in contact zones where great powers meet and where independence is continuously tested. As sovereignty becomes more expensive, the number of true sovereigns shrinks. Strategic inequality grows. Legal equality remains, but hierarchy returns as the operating reality of international politics.

Trade in a Reconfigured Order

The rise of sovereignty produces a form of mercantilism shaped by security. Markets, technology, energy, logistics, and capital are treated as instruments of state power. Control over chokepoints (geographic, technological, scarce resources) matters more than marginal cost. The rise of sovereignty does not end globalization but it does change its operating logic. Trade and capital flows will persist but security objectives and constraints define what markets can do with the two sovereigns setting the terms. In sum, the future will be characterized by characteristics reminiscent of an earlier time: strategic inequality, bloc economics, sovereign competition, and conditional cooperation.

Likely Trends and Unlikely Outcomes

The most likely outcome is managed trade and licensed globalization in sensitive sectors. Supply chains reorder into blocs. Near-shoring and friend-shoring expand. Rules of origin and trusted-vendor requirements become routine. Firms pay for redundancy, inventories, and compliance. Technology ecosystems bifurcate into two separate and competing standards and platforms, which raises friction and costs and lowers efficiency. We see this at work with Huawei’s smartphone and 5G telecommunications stack competing with that of Nokia and Ericsson and running up against U.S. security concerns, the U.S. versus Chinese satellite navigation and positioning systems (the U.S. GPS versus the Chinese BeiDou), and artificial intelligence models such as China’s DeepSeek and Baidu’s ERNIE versus OpenAI and, Google Gemini, and Anthropic in the U.S. to name a few.

The least likely outcomes are full economic isolation or the collapse of the dollar-based financial system. The costs of isolation are too high for any major power that still depends on external inputs and external markets. The dollar system remains dominant because its depth and liquidity are not easily replaced. Smaller states will mostly comply rather than compete because they cannot finance strategic redundancy at scale.

Europe’s Capacity for Sovereignty

Europe has the material foundations of sovereignty. It has industrial depth, capital and regulatory reach, and capable militaries. What it lacks is unified political authority. Sovereignty requires decisions that are fast, binding, and enforceable. Europe’s current structure makes those decisions difficult in crisis. A unified Europe could become sovereign by building a single military command, a common fiscal mechanism, and a coherent external economic perimeter. It would also need credible capital insurance tied to European political authority, including a nuclear deterrent posture anchored to Europe’s decision structure. Until then, Europe remains a major economic space with limited strategic autonomy, protected by an external sovereign, and constrained by its own internal vetoes. In geopolitics, this is the difference between being a pole and being a prize. Europe can either unify and accept the disciplines of sovereignty, or it can remain rich, influential, and dependent when the system hardens.

Le informazioni e le opinioni qui contenute non costituiscono un invito alla conclusione di un contratto per la prestazione di servizi di investimento, né una raccomandazione personalizzata, non hanno natura contrattuale, non sono redatte ai sensi di una disposizione legislativa e non sono sufficienti per prendere una decisione di investimento. Le informazioni e i dati sono ritenuti corretti, completi e accurati. Tuttavia, Banor non rilascia alcuna dichiarazione o garanzia, espressa o implicita, sull’accuratezza, completezza o correttezza dei dati e delle informazioni e, laddove questi siano stati elaborati o derivino da terzi, non si assume alcuna responsabilità per l’accuratezza, la completezza, correttezza o adeguatezza di tali dati e informazioni, sebbene utilizzi fonti che ritiene affidabili.

I dati, le informazioni e le opinioni, se non altrimenti indicato, sono da intendersi aggiornati alla data di redazione, e possono essere soggetti a variazione senza preavviso né successiva comunicazione. Eventuali citazioni, riassunti o riproduzioni di informazioni, dati e opinioni qui fornite da Banor non devono alterarne il significato originario, non possono essere utilizzati per fini commerciali e devono citare la fonte (Banor SIM S.p.A.) e il sito web www.banor.it. La citazione, riproduzione e comunque l’utilizzo di dati e informazioni di fonti terze deve avvenire, se consentito, nel pieno rispetto dei diritti dei relativi titolari.

Banor SIM S.p.A., via Dante 15 – 20123 Milano, iscritta al Registro delle imprese di Milano 06130120154 – R.E.A. Milano 1073114. Autorizzazione Consob delibera n. 11761 del 22/12/1998. Iscritta all’Albo delle SIM al n. 31 e aderente al Fondo Nazionale di Garanzia.