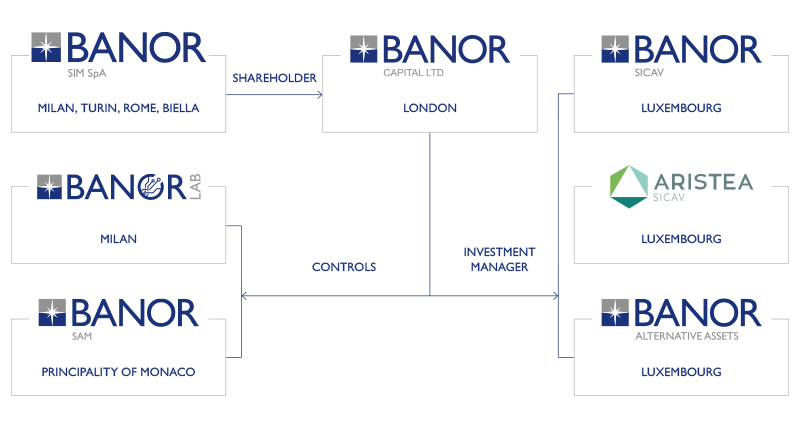

The goal of Massimiliano Cagliero and his partners was to create an independent private banking hub in Italy that would put value investing principles into practice.

With offices in the heart of Milan, Turin, Rome and Biella, Banor SIM is now one of Italy’s leading securities firms. It specializes in capital management and advisory services for high net worth individuals, institutional clients and complex entrepreneurial families. The excellence of professionals and family office experts allows Banor to act as a trusted financial advisor to understand the needs of each client and build a relationship that will last over time. Furthermore, the experience and independent views of Banor SIM’s managers have helped build unique relationships in the international capital markets. These relationships have made BANOR a beacon for many foreign investors who intend to invest in Italy or who are simply seeking an independent view of the Italian market.