The sustainable financial approach plays a crucial role in creating long-term value, managing risks and promoting a positive impact on society and the environment.

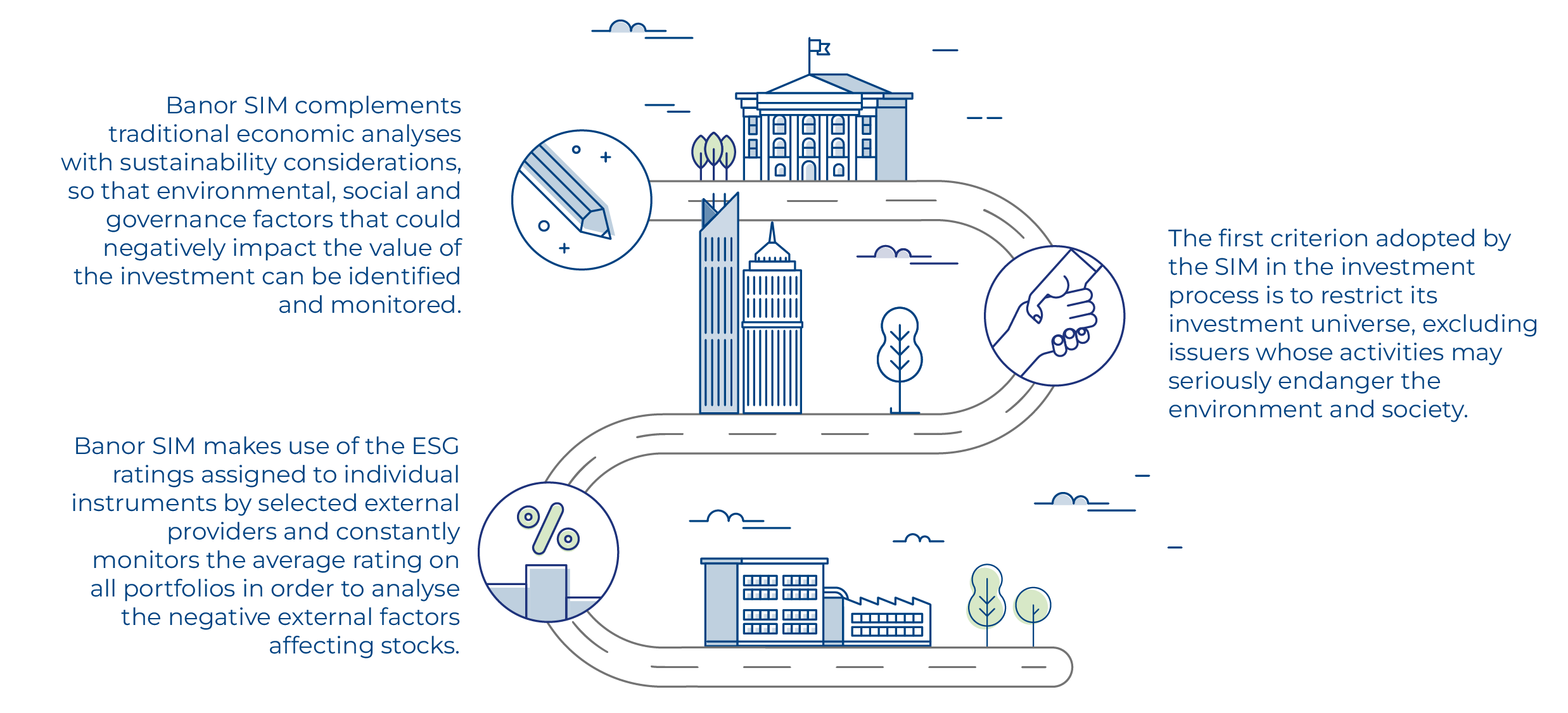

Banor’s fundamental analysis and ‘Value’ approach to investing is Sustainable and Responsible because it integrates environmental, social and corporate governance (ESG) criteria into the strategies for evaluating and selecting stocks.