The hunt is on to buy undervalued stocks – but they’re a rarity.

Hard to find them, after five and a half years of rising markets. How to choose them? The identikit is quickly sketched out: “Good buys are: stocks of companies with low multiples, high cash flow, and constant and growing dividends”, explains Massimiliano Cagliero, CEO of Banor. Here’s the expert’s advice on the best bets in the world’s stock markets.

Milan

After five and a half years of rising markets, at least as far as Wall Street is concerned but less so for Piazza Affari in Milan, finding undervalued stocks is becoming increasingly difficult. Yet identifying companies that still have the potential to grow in the stock exchange is vitally important to avoid the risk of heavy losses when share prices change direction or even just undergo a heavy adjustment, a possibility that can by no means be ruled out.

“In a context like today’s it’s extremely important to adopt a value strategy”, explains Massimiliano Cagliero, CEO at BANOR SIM, a company that has made value investing the pillar of its investment policy. “Today, I view it as dangerous to buy an index, while I’m convinced that a bottom-up approach can provide value”. According to Cagliero, a value approach to capital management also allows investors to take a very relaxed view of potential adjustments in equity values. “Value investors are those who buy a stock because they consider it to be undervalued. If the stock falls after their first purchase, they increase their exposure because it means they can buy it at an even better price”.

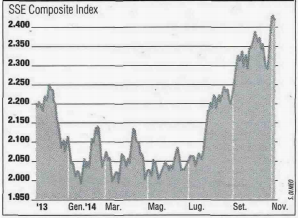

So the problem is how to select the stocks, but the identikit of the “right” stock can be quickly sketched out: “low multiples, high cash flows and constant and growing dividends”. For the head of BANOR SIM, the equity panorama is highly varied and leaves ample margins for manoeuvre for investors who study companies’ financial statements and base their selection on evaluations. “Wall Street is not, in my view, undervalued but it’s certainly fully valued. Europe has some fully valued markets and others where ratings are low, like Italy for example. Lastly, China is offering the lowest multiples of the last 20 years and is at present the most interesting market”. This doesn’t mean, however, that the United States should be ruled out a priori. Companies like Philip Morris and Google have passed the BANOR SIM selection test. The first is attractive in view of the stability of the business and of the cash flows and dividends. And, while the second doesn’t distribute coupons and does not have value stock multiples, it does operate in a position of near monopoly: anyone who wants to access the Internet from their computer or their smartphone, needs to do so through the “Big G”. Staying in the United States, “whose economy is sound and where investors are in risk-on mode”, the pharmaceutical sector is extremely interesting, given the intense merger and acquisition activity.

The natural destination for value investors right now, however, is China, even though the economic forecasts are talking about a further slow-down. “According to our analyses, Beijing’s growth could slow from its current 7.5% to 5%, but you also need to bear in mind that the Chinese president, Xi Jinping, has a power that not even Deng Xiaoping enjoyed. And from a long-term perspective, he’s making all the right moves”, explains Cagliero. “Anyone buying Chinese stocks today and locking them away in a drawer for at least 3 years will obtain some very satisfactory results”. The sector to focus on is consumer domestic, where the price-earnings multiple is 3.5, a value that does not come near to reflecting the potential arising from the growth in the number of middle-class households. The financial and real estate sectors, on the other hand, are showing some problems. Anyone looking for good deals in the financial sector should look to either Wall Street or Europe. “AIG stocks are undervalued, in our view”, continues Cagliero. “So are the principal US banks, whose stocks are suffering as a result of the fears raised by the billion-dollar fines the supervisory authorities are handing out to the big players”.

In Europe, he is entirely focused on Piazza Affari. “The banking sector has suffered but the asset quality review conducted by the European Central Bank has demonstrated the good state of health of Italy’s principal banks. If I had to choose one stock in particular, I’d opt for Intesa Sanpaolo Risparmio which, in addition to its potential to appreciate, is providing dividends of at least 6 cents”. And dividends are one of the cornerstones of value investing: suffice to say that very-long-term investors on Wall Street have earned as much as half of their (enormous) earnings from coupons. BANOR’s expert likens a value investor to someone who buys a city-centre flat with a good rent (the dividend). Following this approach, a number of utilities can also be bought on the Italian list, such as Snam Rete Gas and Arianna, whose stocks provide a good coupon and will benefit from the economic recovery when it comes.

Cagliero has one last tip to offer – the mining sector, which has suffered recently from the weakness of gold but has sound companies with good dividends. Not all sectors in difficulty attract value investors’ attention, however, because in many cases the low evaluations are more than justified by business performance. “We keep well away from sectors undergoing structural crises”, concludes BANOR’s CEO. “And British retailers are among that group”.

(m.fr.)

Original article in Italian language, available here: Affari & Finanza, November 24, 2014.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice, according to the Italian Legislative Decree n° 58/98. The contents of this site may not be reproduced or published whole or in part, for any purpose, or disclosed to third parties.