Commentary by Gianmarco Rania, Portfolio Manager at Banor

High-Dividend European Equities

This is a historic moment for high-dividend European companies. Today, it’s possible to build portfolios of European equities targeting a total dividend yield of 6-7%, thanks to particularly favorable conditions for an asset class traditionally considered ideal for long-term investors.

Several factors are contributing to this compelling scenario in which dividend yields are taking center stage.

Let’s take a step back: the COVID period led to an increase in cash reserves, driven by an unusual drop in investments combined with lower or controlled cost structures. These dynamics strengthened balance sheets and boosted profits.

The rise in inflation and the subsequent economic recovery further supported this trend.

It’s worth noting that European companies (as measured by the STOXX Europe 600 index) currently rank second in terms of free cash flow yield, just behind the FTSE 100 – which includes high-cash-generating businesses in the energy, financial, and tobacco sectors.

To the rising dividend yield, we can now add the effect of the devaluation of European stock prices compared to U.S. equities – a dynamic that further enhances the opportunity.

When comparing the European and U.S. markets, we see a dual divergence: on one hand, for instance, the STOXX Europe 600 offers a dividend yield of 3.54% compared to 1.36% for the S&P 500. On the other hand, European and U.S. indices are at their greatest divergence with respect to each other since the 1950s.

Analysts estimate that dividend yields in the European equity market will continue to grow at an annual rate of up to 7% (source: Morgan Stanley).

This trend is also confirmed by the most recent financial statements released by Italian listed companies in recent weeks, which are forecasting higher dividends (see Intesa Sanpaolo and Snam).

Looking ahead, we expect a gradual normalisation of this scenario, supported by various macroeconomic and geopolitical factors that could drive a revaluation of European equities: the ECB potentially cutting rates more than the Fed, the recovery of the Chinese market – to which Europe is highly exposed – the German elections, and the possible resolution of the Russia-Ukraine conflict. However, there is still ample room for growth, making this an attractive and sustainable medium-term investment opportunity.

Another key contributor to total shareholder return is share buybacks – a practice traditionally associated with the U.S. market that is now gaining momentum in Europe, especially in the financial sector. On one hand, we now see total yields reaching double digits (6-7% from dividends plus another 3-4% from buybacks); on the other, there’s the potential for capital appreciation given that European stock valuations remain near historic lows.

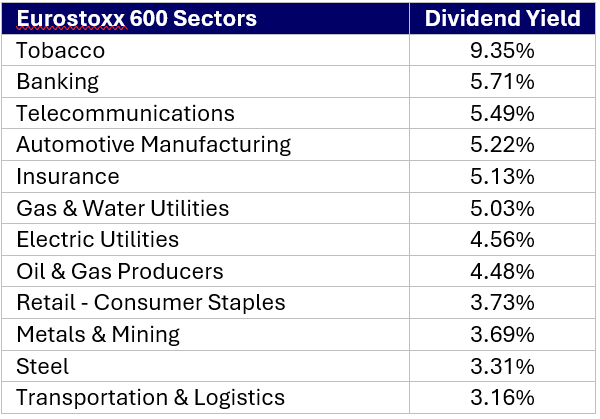

What’s surprising is that, unlike in the past, the investable universe has now expanded to almost all sectors – although the most attractive ones remain banking, insurance, telecommunications, utilities, and commodities.

In the financial sector, Poste Italiane stands out as a particularly interesting stock. A leader in fast-growing areas such as life insurance and digital payments, Poste offers exposure to a wide range of financial services without credit risk. In addition, its strong capital position and high dividend yield (close to 7%) make it, in our view, a compelling investment.

On a more international note, in the energy sector, British Petroleum (BP) is worth highlighting. The stock offers a dividend yield of 6.5%, which increases to 8-8.5% thanks to a robust share buyback program. The recent entry of activist fund Elliott into the shareholder base will likely lead to strategic changes aimed at extracting greater value – and potentially increasing shareholder returns even further.

The opportunities currently offered by high-dividend European equities also invite broader reflection on asset allocation choices. Comparing the risk/return profile of a BTP (Italian government bond) to that of a European stock in a regulated business, one can potentially make much more efficient investment decisions – without giving up stable cash flows and with a relatively limited risk profile.

In two words: carpe diem!

Source: Bloomberg, data elaborated by Banor

The information and opinions contained herein do not constitute an invitation to take out a contract for the provision of investment services, nor a personalised recommendation; they are not contractual in nature, they are not drafted pursuant to a legislative provision, and they are not sufficient to make an investment decision. The information and data are deemed to be correct, complete and accurate. However, Banor does not issue any representation or guarantee, express or implied, on the accuracy, completeness or correctness of the data and information and, where these have been prepared by or derive from third parties, does not assume any liability for the accuracy, completeness or adequacy of such data and information, even if its sources are deemed to be reliable.

Unless indicated otherwise, the data, information and opinions are understood to be up-to-date at the date of preparation, and may change without notice or subsequent communication. Any citations, summaries or reproductions of the information, data and opinions provided herein by Banor should not alter their original meaning, nor may they be used for commercial purposes, and they must cite the source (Banor SIM S.p.A.) and the website www.banor.it. Citation, reproduction and use in any case of data and information from third-party sources must, if permitted, fully comply with the rights of the related data controllers.

Banor SIM S.p.A., via Dante 15 – 20123 Milan, registered in the Business Register of Milan 06130120154 – R.E.A. (Economic and Administrative Index) of Milan 1073114. Consob authorisation, resolution no. 11761 of 22/12/1998. Registered in the Register of Brokerage Companies (SIM) under no. 31 and member of the Italian National Guarantee Fund (Fondo Nazionale di Garanzia).

Gianmarco Rania is the Portfolio Manager of the Banor SICAV European Dividend Plus sub-fund.